The official IndigoCard is only a Platinum Mastercard, which has a low credit limit for those who have it. The line of credit at the IndigoCard Login doesn’t offer offers and rewards to cardholders like other credit cards do.

Instead, it has fewer qualifications and eligibility criteria. Compared to other card issuers in the same line, Indigo Card has a low, fixed credit limit of $300, which many people think is fair but which the official committee hasn’t come up with a way to explain.

Because of this one lower limit, the Indigo Card Pay is a better card for people who want to build credit than for people who only buy things online.

What’s New at IndigoCard Login

This means that there are several other useful features that cardholders can get along with the offers and benefits.

- The approval rules for credit ratings are not as strict and are much easier to understand.

- At the IndigoCard Login portal, people who have an IndigoCard do not need to make a sole deposit to secure their line of credit.

- The most that cardholders can borrow with an Indigo Card is $300.

- You can choose ahead of time at the portal without having to worry about your credit score.

- The easy selection process and quick response at the login page.

- All mobile devices can connect to your free online account.

- If you lose or have your card stolen, the Indigo Card Pay will protect you from fraud.

- Accepted at more than 35 million places around the world for purchases both online and off.

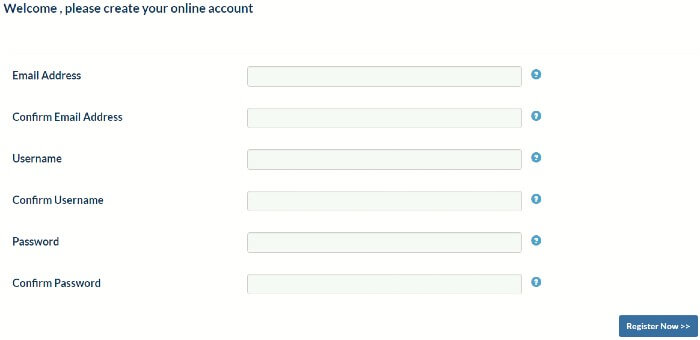

Cardholders may want to know if there is a relevant route that will get them there faster for the login and activation process. The people who work in customer service help all active cardholders find different routes or times. That being said, anyone with an IndigoCard can get help with the login process and find instructions and guidelines on the official website.