The credit limit for the IndigoCard Login is only $300, or maybe even less because the official charges are being shown less. For example, if you have an official account that costs $59 a year, your credit limit might be $241 based on how much the cardholder thinks installation and maintenance will cost the customer.

Since the IndigoCard is given out based on your credit limit, it’s easy to build up a high credit score. In some cases, this can even hurt your score while you’re trying to improve it at the IndigoCard Login. Also, the low credit limit at the portal is not worth the high annual fees.

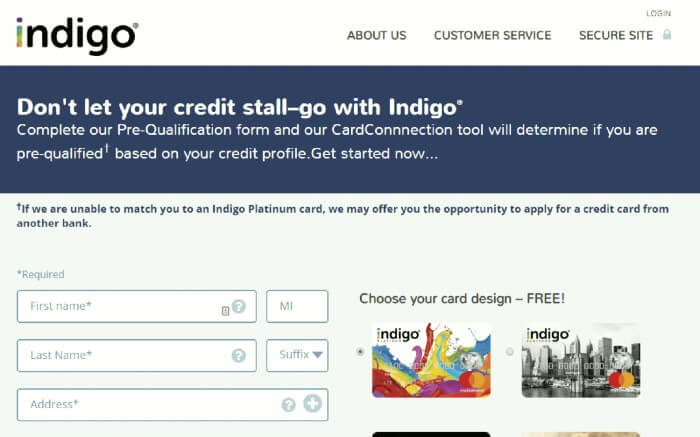

Anyone with an official IndigoCard Login can use their credit card for both online and offline purchases, no matter what their credit score is or how bad it was in the past. But that might not be enough for cardholders to show that they need this one card when there are better options at the platform that meet the same needs.

But if you have bad credit, it might be better to get a secured or unsecured credit card. With an IndigoCard, the credit limit is usually only as high as the amount you deposit.

You will get your deposit back if you have a good payment history or plan to make one. It doesn’t matter how much you put down. The maximum amount of money that can be borrowed with an IndigoCard is $300. It’s not clear if this amount can go up in future online or offline transactions if you use the card on more than one platform.

The Indigo Card doesn’t have an annual fee at www.indigocard.com, and it also doesn’t charge a lot of other fees that the Indigo Platinum Mastercard and most other cards of this type do, like fees for using the card overseas or for paying late.